The Renewal Reckoning: The High Price of Low Engagement

Another renewal season is on the horizon and for many, this one feels different. HR leaders and the benefits consultants they work with are feeling...

Connected Navigation Platform

Guiding to high-value care

Behavioral Health

Foster a mentally healthy workplace

EAP

Supporting holistic wellbeing

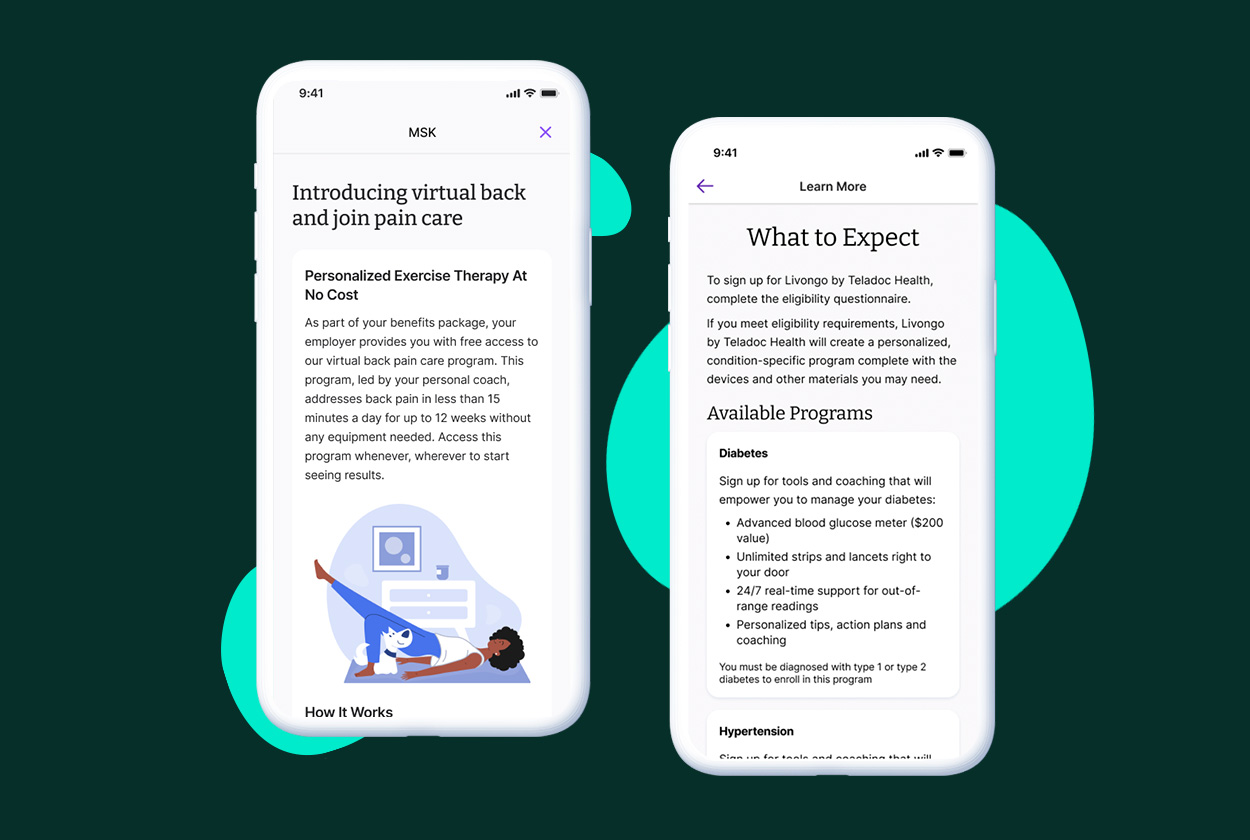

Virtual MSK Care

Reimagining musculoskeletal care

Virtual Primary Care

Powered by smart navigation

Surgery Centers of Excellence

Best-in-class surgical outcomes

Virtual Urgent Care

Immediate care, any hour of the day

Chronic Care

A new approach to chronic care

Integrations

Flexible to any strategy

4 min read

Justin Holland

:

October 29, 2025

Justin Holland

:

October 29, 2025

When the pressure to contain healthcare costs becomes unbearable, some employers find what looks like a silver bullet: the Individual Coverage Health Reimbursement Arrangement (ICHRA). On paper, it sounds like relief. You set a fixed contribution amount, shift employees to the individual market, and stop absorbing the risk of unpredictable claims. The cost problem is seemingly solved.

But for many, this “solution” isn’t a strategic win; it’s a symptom. It’s the result of a long, losing battle to contain healthcare spend. And while it promises financial predictability for the employer, it often creates a new set of problems: member abrasion, fragmented care, and a future of employee backlash.

For benefits consultants on the front lines, ICHRAs are not a villain to be fought, but a cautionary tale to be told. The true victory isn’t convincing a client to avoid an ICHRA; it’s providing them with the tools and strategies to ensure they never feel forced into one in the first place.

ICHRA's primary appeal is simple and powerful: cost control. By moving employees to the individual market, an employer caps their contribution. The unpredictable, year-over-year renewal roller coaster is replaced with a fixed budget. In a market where many fully insured groups are seeing renewal increases of 15% or more, this predictability can look like an act of financial survival.

ICHRAs can also be a viable option in certain scenarios including:

In these cases, an ICHRA isn’t a sign of failure; it’s a pragmatic, strategic choice. However, these represent a small fraction of the market. For most companies, the move to an ICHRA is an admission of defeat. It's the moment an employer realizes they’ve run out of effective tools to manage their healthcare spend and are ready to pass the risk—and the burden—onto their employees.

The promise of cost containment from an ICHRA often masks a new set of problems that can undermine employee trust and retention.

Ultimately, while the ICHRA looks like a simple fix on the budget sheet, it often leads to a complex and costly long-term problem: a dissatisfied, disengaged workforce.

The conversation with a client should never be about choosing an ICHRA. It should be about providing a proactive strategy so they never have to consider one. This is where a modern benefits consultant proves their value. Instead of being reactive to a client's request, the goal is to be proactive in managing their core cost drivers.

Your goal is to become an indispensable advisor, equipped with the tools to show clients how to take control of their costs without resorting to ICHRAs.

For a benefits consultant, the ability to prevent a client from moving to an ICHRA is the ultimate act of strategic partnership. It proves your worth in a way that no spreadsheet can. The brokers who’ll thrive in the current market are those who can provide their clients with a robust, data-backed strategy that gives them a genuine sense of control.

They will show their clients that there’s a better way—a path that allows them to maintain a strong, unified benefits package while proactively managing costs and keeping employees happy and engaged. The ICHRA isn't the future of benefits; it’s a sign that the old benefits playbook has failed. The new playbook is about providing a strategic solution that works, so your clients never have to lose control again.

Elevate your renewal conversation by demonstrating proven value. Discover how a unified platform can help you centralize client benefits and prove ROI, cementing your role as a strategic advisor. Watch the demo here.

%20(1).png)

Another renewal season is on the horizon and for many, this one feels different. HR leaders and the benefits consultants they work with are feeling...

Suffering from a musculoskeletal (MSK) condition can make it feel like you’re on the sidelines in your own life. This pain can take you away from the...

This renewal season isn’t just another tough cycle—it’s a client retention crisis in the making. While national headlines forecast a modest 6-9%...