Virtual MSK Therapy: Life-Changing and Cost-Saving

Suffering from a musculoskeletal (MSK) condition can make it feel like you’re on the sidelines in your own life. This pain can take you away from the...

Connected Navigation Platform

Guiding to high-value care

Behavioral Health

Foster a mentally healthy workplace

EAP

Supporting holistic wellbeing

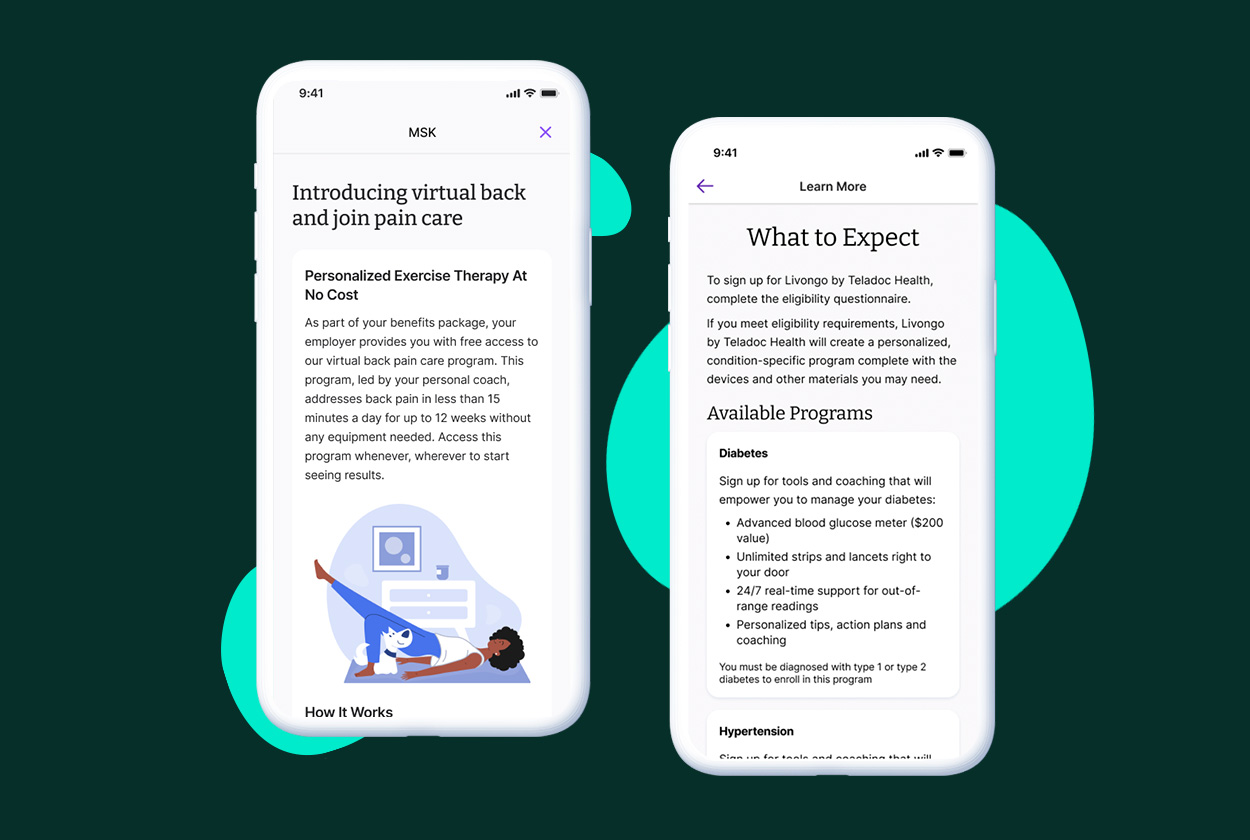

Virtual MSK Care

Reimagining musculoskeletal care

Virtual Primary Care

Powered by smart navigation

Surgery Centers of Excellence

Best-in-class surgical outcomes

Virtual Urgent Care

Immediate care, any hour of the day

Chronic Care

A new approach to chronic care

Integrations

Flexible to any strategy

3 min read

Justin Holland

:

October 21, 2025

Justin Holland

:

October 21, 2025

-1.png)

In the first two installments of our “Renewal Reckoning” series, we explored how brokers can thrive in a volatile market and how to turn the high cost of low engagement into a strategic advantage. But the turbulence we’ve seen so far is just the prelude to a systemic shockwave set to hit in 2026. A perfect storm of legislative shifts, expiring subsidies, and relentless medical inflation is brewing, and its impact will extend far beyond the public insurance markets, landing squarely on your clients’ balance sheets.

This isn’t just another year of difficult renewals. The policy changes taking effect will create a new, more expensive baseline for the entire U.S. health system. For brokers, understanding the complex mechanics of this shift is no longer optional—it is the core strategic mandate for 2026. This analysis breaks down the causal chain, from the turmoil in the individual market to the direct financial consequences for employer-sponsored plans.

The disruption originates in the Affordable Care Act (ACA) Marketplace, which is facing an unprecedented affordability crisis. The primary catalyst being the scheduled expiration of enhanced Premium Tax Credits (ePTCs) on January 1, 2026. This single event will trigger a massive price shock. Projections show that the average out-of-pocket premium for millions of subsidized enrollees will more than double—a staggering 114% increase.

In response to this predictable loss of affordability, insurers are filing for the largest rate hikes in nearly a decade, with a median proposed premium increase of 18% to 20%. Their reasoning is based on the actuarial certainty of adverse selection: as healthy individuals drop their now-unaffordable coverage, the remaining risk pool becomes smaller, sicker, and more expensive to insure.

This crisis is amplified by the "One Big Beautiful Bill Act" (OBBBA), which introduces significant new administrative hurdles that make it harder to enroll and maintain coverage. Simultaneously, OBBBA is making deep cuts to Medicaid by introducing nationwide work requirements and restricting eligibility, changes that will cause millions more to lose their public insurance. The result is a sharp reversal of the coverage gains made over the past decade and a massive surge in the number of uninsured Americans.

Every broker must understand that the turmoil in the individual and Medicaid markets can’t be contained. The dramatic rise in the uninsured population will lead to a massive increase in uncompensated care costs for hospitals and other providers. Under federal law, hospitals must treat patients in an emergency regardless of their ability to pay. The financial impact of this new wave of uncompensated care is projected to be between $31 billion and $36.3 billion annually.

To offset these staggering losses, providers will turn to a time-tested mechanism: cost-shifting. They will negotiate significantly higher reimbursement rates from the most stable block of payers—commercial group health plans. As hospitals face the risk of closure, they will have immense leverage to demand these increases. This forces employer-sponsored plans to subsidize the cost of the newly uninsured, functioning as a "hidden health care tax" that is passed directly to employers and their employees through higher premiums.

This isn’t just a theoretical risk either. An analysis conducted by industry experts provides a model for quantifying this hidden tax, which is estimated to increase the annual cost of coverage by $182 to $485 per employee.

This external shock is colliding with a group market already facing its most severe headwinds in over a decade. National surveys have reached a strong consensus: even before accounting for the spillover effect, baseline premium increases for 2026 are projected to be between 6.5% and 11%.

These increases are driven by powerful factors you already see with your clients including:

The synthesized forecast is clear: the high baseline projections of 6.5% to 11% should be viewed as the floor, not the ceiling. When the "hidden tax" from uncompensated care is layered on top of these already severe trends, the final rate increases will be pushed significantly higher.

It is highly probable that the average premium increase for employer-sponsored group health plans for the 2026 plan year will settle in the high single digits to low double-digits, likely in the 9% to 13% range. This represents the most significant and painful cost escalation for businesses in more than a decade.

The magnitude of this projection means that business as usual will be insufficient to manage the financial impact. For many employers, absorbing a double-digit increase is impossible, making significant cost-shifting to employees through higher contributions and deductibles almost inevitable.

Think of the 2026 cost surge as a tidal wave gathering force offshore. Simple plan design tweaks are like sandbags; they won't be enough. What your clients need now is a financial seawall, and you are the architect.

Building this defense isn’t just about securing a better renewal; it’s about fundamentally restructuring their benefits strategy to withstand the market’s pressures for years to come. As the architect, your first step is to proactively implement strategies like high-performance networks, transparent PBMs, and rigorous claims oversight to protect the plan from uncompensated care costs that will flood the system. This starts with identifying the specific vulnerabilities that can breach the seawall—the hidden "loss leaders". Understanding how to spot and manage these is the key to building a truly resilient strategy.

Learn more about how to curb these “loss leaders” here.

Suffering from a musculoskeletal (MSK) condition can make it feel like you’re on the sidelines in your own life. This pain can take you away from the...

Companies are losing the battle against rising healthcare costs without healthcare guidance. Costs are continuing their steady climb with annual...

The Problem The US healthcare system is confusing, overwhelming, fragmented, and frustrating. For employees, the consequences of this unapproachable...